Madrid, 11 February 2021. Spain is gradually increasing the use and acceptance of mobile payments, while the use of cash is decreasing, according to the ‘Study of mobile payment trends in Spain’ carried out by the Spanish fintech Pecunpay, specialized in groundbreaking payment and electronic money processing solutions, partnered with Visa, the leading digital payment technology company.

Payment methods in Spain are undergoing a profound transformation. Even before the pandemic, we could observe digital payments were gradually growing. As a result, the use of mobile payments, though in an incipient way, was on the rise among Spaniards. For instance, 34% of the 2000 people who have taken part in this study say they make payments with their mobile. Furthermore, mobile payments are the third preferred payment option (12%), right after cards (60%) and cash payments (22%).

Of those who pay with their mobile, almost 7% say they always use their device as a payment method, 11% often and 16% sometimes. Likewise, mobile payments were the most widely used payment method amongst men (38.6%), those aged between 18-29 (38%) and 30-44 years (37.9%), and the residents of the Regions of Cantabria (46%), Madrid (45.5%) and Catalonia (44%).

Antonio García Cruz, CEO of Pecunpay, says: ‘This study shows that consumers are clearly demanding access to mobile payments. At Pecunpay, we are going to further innovate in this regard, with initiatives such as our agreement with Visa, with whom we have recently launched the implementation of the Xpays service or mobile payments with ApplePay and GooglePay, where users will be able to add Visa/Pecunpay cards to their mobile devices and pay at any establishment or e-commerce, or even through their Apple and Google wallets’.

Carmen Alonso, the Director of Business Development at Visa for Southern Europe, says: ‘I am sure the implementation of digital payments also has to do with the confidence and security they offer to users and merchants. In recent months where we have experienced an increase in contactless payments and e- commerce, fraud has remained at historic lows. This is why at Visa we work to offer the best security solutions to protect the payment ecosystem while partnering with relevant agents such as Pecunpay to bring the most cutting-edge technology to the market’.

Recurrence and benefits

Of the 34% of respondents who currently pay with their mobile, almost 7 out of 10 (67%) state they have increased their use since the beginning of the pandemic. The main benefits include avoiding contact with surfaces (63%), the speed of this method (62%) and the ease of use (47%).

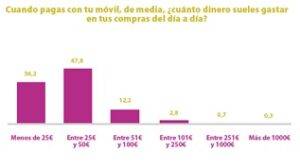

Moreover, their average expenditure when they pay with their mobile is below €50, where almost half of them (47.8%) spend €25-50 and 36% spend less than €25.

Consumers demand greater acceptance of mobile payments in stores for the future

With regard to the type of business where mobile payments are made, 58% of these payments take place in large shopping areas, and 28% in small businesses.

Even though the trend in the use of mobile payments is on the rise, users still perceive there are certain barriers to achieving a more regular use. In this regard, 58% of those who make payments with mobile phones miss a greater acceptance of this payment method from establishments, while 41% call for greater security. Greater acceptance from establishments is mostly claimed by men (63.2%), while women emphasize security (48.3%).

Pecunpay & Visa: a partnership for innovation

This study is part of the collaboration that Pecunpay and Visa started in April 2019, when Pecunpay partnered with Visa to offer cutting-edge technology and innovation to its clients. Therefore, they made the strategic decision to directly operate through Visa’s global network (VisaNet), for Pecunpay and its clients to take advantage of VisaNet’s resilience and scalability, which not only allows for agile, simple and safe steps, but also for a wide range of innovative products and digital payment solutions, such as the latest technology to prevent and detect fraud.

As a result, in 2019, this collaboration agreement boosted Pecunpay’s business, increasing the issuance of Visa cards by 150%, marking a 10-fold increase in its client portfolio compared to the previous year.

As part of this agreement, Pecunpay has also carried out its latest launch, which consists of the implementation of the Xpays or mobile payment service with ApplePay and Google Pay, which allow adding physical or virtual Visa/Pecunpay cards to mobile devices or wearables to pay at any establishment, e-commerce or even through Apple and Google wallets. This new feature is one of the most sought-after by Pecunpay clients, and it is expected to continue enhancing the company’s issuing business.

About Pecunpay

Pecunpay is an electronic money institution (EMI) supervised by the Bank of Spain (BdE, in Spanish) filed with code CSB 6707.

This EMI offers its clients bespoke solutions for their payment method programs, providing them with legal coverage and technology through integration processes based on APIs, respecting their business idea and image by using a white-label model.