- 2021 Annual Results: First IFRS consolidated statements integrating the subsidiary Carbiolice

- Plan to build a first industrial facility with a strong financial support from the French Government and the Grand-Est Region: site selected in France in partnership with Indorama Ventures, world leader in the production recycled PET

- Successful commissioning of a demonstration facility in September 2021 and confirmation of the validity of the scale-up of Carbios’ enzymatic recycling technology

- Takeover of Carbiolice and full integration in the consolidated IFRS statements since June 4th, 2021

- Appointment of Philippe Pouletty as Chairman of the Board of Directors on April 1st, 2022

- Appointment of Emmanuel Ladent as CEO of the Company on December 1st, 2021

- Strengthening of Carbios’ financial structure: capital increase of €114 million with French and International investors and €30 million loan from the European Investment Bank (EIB)

- Group’s cash position of €105 million as of December 31, 2021, which does not include the €30 million EIB loan due to be drawn down in the first half of 2022

CLERMONT-FERRAND, France–(BUSINESS WIRE)–Regulatory News:

Carbios (Paris:ALCRB) (Euronext Growth Paris: ALCRB), a pioneer in the development of enzymatic solutions dedicated to the end-of-life of plastic, announced today its operating and financial results for the year 2021. The financial statements as of December 31, 2021, were approved by the Company’s Board of Directors at their meeting on March 31, 2022. The Company’s accounts have been audited by the Statutory Auditors and are available on the Company’s website.

“In 2021, Carbios achieved several technical and industrial milestones testifying of the soundness and successful execution of our strategy. The excellent results obtained from our demonstration plant confirms the industrial scale-up potential of our biological technology for the recycling of PET plastics and fibers. Together with our Consortium members, we also produced the world’s first food-grade PET sample bottles produced entirely from enzymatically recycled plastics; a world first. In addition, we have strengthened our financial structure by raising a landmark €114 million in May 2021 and we have taken full control of Carbiolice in June. In line with our objectives and with a strong financial support from the French Government and the Grand-Est Region, we will soon enable France to host the world’s first industrial facility dedicated to the biological recycling of plastics. Carbios’ enzymatic process will make it possible to recycle more than 50,000 tons of PET plastic waste per year,” comments Emmanuel Ladent, CEO of Carbios. “Our priority for 2022 is to finalize the terms of our partnership with Indorama Ventures, which will host the world’s first industrial facility operating our biological recycling process at its French production site in Longlaville. This year will also be about optimizing our commercial strategy, while continuing our innovation efforts on the end-of-life of other polymers.”

A webcast and a conference call will take place today at 3:00pm CEST (Paris time)

Emmanuel Ladent – Chief Executive Officer / Kader Hidra – Chief Financial Officer

Access to the webcast: https://channel.royalcast.com/landingpage/carbios-fr/20220401_1/

Paris: +33 (0) 1 70 37 71 66 UK-Wide: +44 (0) 33 0551 0200 New York: +1 212 999 6659

FINANCIAL HIGHLIGHTS FOR 2021

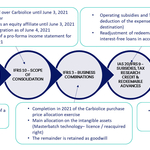

The financial statements of the Company as of December 31, 2021, are the first consolidated financial statements presented in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB) and adopted by the European Union, and especially in application of IFRS 1 “First-time adoption of International Financial Reporting Standards” at the date of preparation of the financial statements.

These IFRS financial statements include the financial statements of Carbios, the parent company, as well as the equity-accounted securities of its subsidiary Carbiolice until June 3, 2021, and then the fully consolidated financial statements of the later as of December 31, 2021, following Carbios’ acquisition of control on Carbiolice. The group formed by Carbios and Carbiolice is hereinafter referred to as the “Group”. In application of IFRS 3, the assets acquired and the liabilities assumed from Carbiolice were initially recognized at their fair value at the acquisition date.

These IFRS financial statements for the Group have been prepared to provide high quality information in line with that of similar companies and based on international standards.

The Group’s IFRS consolidated accounts are available on the Company’s website

Summary of the main issues of this IFRS conversion:

Statement of income and “adjusted” indicators reflecting the effects of IFRS 3 following the takeover of Carbiolice:

|

Consolidated statement of Income (in thousand euros) |

|

December 31, 2021 |

|

December 31, 2020 |

|

|

12 months |

|

12 months |

|

|

Income |

105 |

128 |

||

|

Net Research and Development expenses |

(7,727) |

(3,176) |

||

|

Research and development expenses |

(11,732) |

(5,698) |

||

|

Subsidies and other income from activities |

3,597 |

2,522 |

||

|

Capitalisation of development costs |

409 |

– |

||

|

Sales and marketing expenses |

(1,976) |

(1,253) |

||

|

General and administrative expenses |

(6,251) |

(1,983) |

||

|

Operating expenses |

(15,953) |

(6,412) |

||

|

Other operating income and expenses (1) |

21,211 |

603 |

||

|

Operating income (2) |

5,363 |

(5,682) |

||

|

Financial income |

(454) |

(313) |

||

|

Income before tax |

4,908 |

(5,995) |

||

|

Income Tax |

– |

– |

||

|

Share of profit (loss) of equity affiliates (3) |

(1,128) |

(2,278) |

||

|

Net income (loss) for the period (4) |

3,780 |

(8,273) |

||

|

IFRS accounting impact related to the takeover of Carbiolice: |

|

|

|

|

|

Other operating income and expenses (1) |

|

21,211 |

|

603 |

|

Share of profit (loss) of equity affiliates (3) |

|

(1,128) |

|

(2,278) |

|

Operating income (loss) “adjusted” of the IFRS impacts related to the takeover of Carbiolice (2)-(1) |

|

(15,848) |

|

(6,285) |

|

Net Income (loss) “adjusted” of the IFRS impacts related to the takeover of Carbiolice (4)-(1)-(3) |

|

(16,303) |

|

(6,598) |

- Income according IFRS 15 standards

For the financial years 2020 and 2021, income accounted under IFRS 15 are related to feasibility studies, tests, and research services, as well as deliveries of raw materials and samples of the Masterbatch Evanesto® by Carbiolice.

As of December 31, 2021, the Group’s income stood at €105 thousand, compared to €128 thousand for the year ended December 31, 2021.

- Operating expenses – Current portion

With regards to the presentation of its IFRS consolidated statements, the Group shows a statement of income by destination. Thus, current operating expenses are categorized a presented as: Net Research and Development expenses, Sales and Marketing expenses, as well as General and Administrative expenses.

2021 figures include the full-year accounts of Carbios, as well as the accounts of Carbiolice for the period from June 4, 2021 to December 31, 2021, whereas the 2020 figures only show the full-year accounts of Carbios, since Carbiolice was accounted for as an equity affiliate until June 3, 2021. Operating expenses stood at €15,953 thousand for 2021, compared to €6,412 thousand for 2020.

To support the growth of its activities, the average number of employees within the Company increased from 31 in 2020 to 46 in 2021.

Net Research and Development expenses: The Group pursued its research and development efforts on all its proprietary pipeline of innovations and notably on its PET recycling technology. For the year 2021, the Group’s Net R&D expenses stood at €7.727 thousand, compared to €3,176 thousand for 2020.

For the year 2021:

– On R&D, the Group spent €11,732 thousand, in line with its industrialisation ambitions. The significative rise in R&D expenses is mainly due to the commissioning of its industrial demonstration facility and to a lesser extent to the integration of Carbiolice since June 4, 2021. The main changes are explained by the increase in personal expenses due to the growing workforce at the demonstration facility, as well as the use of external services.

– On Subsidies and other income from operations, the Group recorded €3,597 thousand partially offsetting its R&D expenses. This item includes notably a research tax credit of €2,265 thousand for Carbios and €721 thousand for Carbiolice in 2021 (as opposed to respectively €1,488 thousand and €577 thousand in 2020, these amounts having been received in 2021).

– Finally, the Group has capitalized €409 thousand development expenses related to the Company’s PET enzymatic recycling project, from October 1, 2021, in accordance with the capitalization criteria of the IAS 38 standard.

Sales and Marketing expenses: sales and marketing expenses stood at €1,976 thousand in 2021, compared to €1,253 thousand in 2020. This rise of €723 thousand comes mainly from the full integration of Carbiolice since June 4, 2021, and the reinforcement of the Group’s commercial teams to support its developments.

General and Administrative expenses: General and administrative expenses stood at €6,251 thousand in 2021, as opposed to €1,983 thousand in 2020. This increase of €4,268 thousand is mainly due to personnel expenses, as a result of the significant increase in the number of employees in 2021, and to consulting services to a lesser extent.

- Other operating income and expenses, “adjusted” operating income and “adjusted” net income

The application of IFRS standards, as well as the takeover of Carbiolice, dated June 4, 2021, have generated IFRS accounting restatements impacting the consolidated income statement on the aggregate of “Other operating income and expenses”.

As of December 31, 2020, the capital increase, dated October 22, 2020, has led to the dilution of Carbios in Carbiolice, bringing its participation from 70.72 % to 62.71 %. This dilution generated a non-cash item of €0.5 million accounted as “other operating income and expenses”.

As of December 31, 2021, by application of IFRS 3 standards, the sale of the shares accounted for by the equity method of associates (prior to the acquisition of all the shares of Carbiolice) generated a non-cash net bonus valued on the basis of the share previously held by Carbios in Carbiolice at fair value, which amounts to €21.2 million. As a result, these items had no impact in terms of cash flow for the Group.

To ease the reading and understanding of these financial statements, the Group presents an “adjusted” operating income, which corresponds to the operating income restated for items relating to the Carbiolice operations included in “Other operating income and expenses” and which reflects only the impact of revenue and “current” operating expenses. This adjusted operating result corresponds to a loss of €15.8 million as of December 31, 2021, as opposed to €6.3 million as of December 31, 2020; a development mainly related to the above-mentioned R&D and G&A expenses, including the integration of Carbiolice as of June 4, 2021.

The Group also presents a net result “adjusted” of the IFRS impacts of the takeover of Carbiolice, which takes into account the financial result, the income tax, and the restatement/cancellation of the “share of profit (loss) of equity affiliates”. This net “adjusted” result corresponds to a loss of €16.3 million as of December 31, 2021, as opposed to a loss of €6.6 million as of December 31, 2020.

Balance Sheet items

|

Consolidated statement of financial position (in thousand euros) |

|

December 31, 2021 |

|

December 31, 2020 |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

||

|

Goodwill |

|

20,583 |

|

– |

|

Intangible assets |

|

23,188 |

|

1,086 |

|

Tangible assets |

|

16,466 |

|

4,793 |

|

Right-of-use assets |

6,989 |

1,402 |

||

|

Equity accounted securities |

– |

8,272 |

||

|

Financial assets |

|

388 |

|

371 |

|

Non-current assets |

|

67,614 |

|

15,924 |

|

|

|

|

||

|

Trade receivables |

|

16 |

|

155 |

|

Other current assets |

|

6,128 |

|

2,201 |

|

Cash and cash equivalents |

|

104,956 |

|

29,077 |

|

Current assets |

|

111,120 |

|

31,433 |

|

|

|

|

||

|

Total assets |

|

178,734 |

|

47,356 |

|

Consolidated statement of financial position (in thousand euros) |

|

December 31, 2021 |

|

December 31, 2020 |

|

|

|

|

|

|

|

EQUITY AND LIABILITIES |

|

|

|

|

|

|

|

|

||

|

Share capital |

|

7.826 |

|

5,674 |

|

Share and contribution premium |

|

146,337 |

|

59,711 |

|

Consolidated reserves |

|

(10,604) |

|

(10,260) |

|

Retained earnings |

|

(600) |

|

(14,555) |

|

Net income – share attributable to equity holders of the parent company |

|

3,780 |

|

(8,273) |

|

|

|

|||

|

Shareholders’ equity |

146,739 |

32,297 |

||

|

|

||||

|

Provisions – Non-current portion |

202 |

159 |

||

|

Loans and financial liabilities – Non-current portion |

11,941 |

8,221 |

||

|

Lease liabilities – Non-current portion |

5,358 |

1,097 |

||

|

Deferred tax liabilities |

1,694 |

– |

||

|

Non-current liabilities |

19,194 |

9,477 |

||

|

|

||||

|

Provisions – Current portion |

76 |

– |

||

|

Loans and financial liabilities – Current portion |

1,376 |

1,125 |

||

|

Lease liabilities – Current portion |

1,256 |

360 |

||

|

Trade payables |

5,137 |

1,683 |

||

|

Other current liabilities |

|

4,956 |

|

2,415 |

|

Current liabilities |

|

12,801 |

5,582 |

|

|

|

|

|

||

|

Total liabilities and equity |

|

178,734 |

|

47,356 |

As of December 31, 2021, Cash and cash equivalents amounted to €105 million, including €100,9 million for Carbios, as compared to €29,1 million for the year ended December 31, 2020.

The other key balance sheet items as of December 31, 2021 are:

- €20,6 million corresponding to the Goodwill calculated between the market value of Carbiolice and the net assets acquired;

-

Intangible assets for a net book value of €23.2 million for the year ended December 31, 2021;

Pursuing on its active policy of securing its Intellectual Property, the Group continued to enrich its IP portfolio with the filing of 4 new patents and the grant of 13 patent families in key regions of the world in 2021.

As a result of the full integration of Carbiolice, €22.5 million were also recognized for the purchase price of Carbiolice, with a net amortization position of €21.5 million as of December 31, 2021, including:

- €12.0 million net (€12.5 million gross) for the technology license (or “reacquired rights”). Under IFRS 3, the technology license between Carbios and Carbiolice is assimilated to a pre-existing relationship giving rise to the recognition of a “reacquired rights” asset that has been valued using the expected cash flow method; and

- €9.0 million net (€9.8 million gross) market value of the acquired technology (Masterbatch) valued using the royalty and restoration cost method;

- Tangible assets for a net book value of €16.5 million, as compared to €4.8 million for the year ended December 31, 2020. This strong increase is mainly due to equipment investments in the industrial demonstration facility (€9 million) and the development of the Cataroux site in anticipation of the consolidation in 2022 of some of the Company’s main activities, which are currently carried out on 4 different sites;

- Rights-of-use asset for a net book value of €7.0 million corresponding to the market value of the tangible and intangible assets benefiting to the Group through its various lease contracts. In return, “lease debts” are recorded on the liabilities side of the balance sheet as financing for these assets; and

- Shareholder’s equity of €146.8 million, including the net proceeds of the €114 million capital increase successfully completed in May 20211 with French and International investors, as compared to 32.3 million for the year ended December 31, 2020.

Carbiolice shares accounted for by the equity method in the financial statements as of December 31, 2021, for a total amount of €8.3 million have been neutralized for the year ended December 31, 2021. This restatement follows (i) the acquisition of the SPI fund’s entire stake of 38.29 % in Carbiolice, which was paid €17.9 million in June 2021 exclusively in cash and (ii) the full consolidation of Carbiolice by its parent Company Carbios. To date, Carbios holds 29.5 million shares of Carbiolice valued at €37.4 million in its financial statements.

Cash flow statement

|

Consolidated cash flow statement (in thousand euros) |

|

December 31, 2021 |

|

December 31, 2020 |

|

Cash at beginning of year |

|

29,077 |

|

15,895 |

|

Cash flow from operating activities |

|

(8,929) |

|

(4,667) |

|

Cash flow from investing activities |

(22,837) |

|

(9,252) |

|

|

Cash flow from financing activities |

107,646 |

|

27,101 |

|

|

Change in cash position |

75,880 |

|

13,182 |

|

|

Cash at end of year |

104,956 |

|

29,077 |

Benefiting from the net proceeds of the €114 million raised during the exercise, as well as from the funding from ADEME under the CE-PET project and grants received through the LIFE project of the European Commission, the Group closed out with a net cash position of €105 million at year-end 2021, enabling it to pursue current developments beyond the next 12 months.

As of December 31, 2021, this net cash position of €105 million does not include the €30 million loan granted to Carbios by the European Investment Bank (EIB)2 which is due to be drawn down in the first half of 2022.

2021 AND POST-CLOSING HIGHLIGHTS:

- Construction of a first industrial Unit

In April 20213, Carbios announced a plan to build its first manufacturing Unit exploiting its C-ZYME™ technology for fully bio-recycled PET.

In February 20224, the Company and Indorama Ventures announced a collaboration to build the world’s first 100 % biorecycling plant in France. This industrial Unit, which will be based in Longlaville, should be operational in 20255, creating 150 direct and indirect jobs. Its processing capacity is estimated at 50,000 tons of waste per year, equivalent to 2 billion bottles.

- Commissioning of the industrial demonstration plan operating Carbios’ C-ZYME™ technology

In September 20216, Carbios announced the operational start-up of its demonstration plant in Clermont-Ferrand. This pre-industrial facility, equipped with a 20,000-liter hydrolysis reactor capable of treating 2 tons of PET waste in less than 24 hours (the equivalent of 100,000 bottles), represents the final stage of development of the process and prefigures the design of future industrial units. By the end of 2022, Carbios intends to finalize the complete engineering documentation of its enzymatic recycling process (PDP: Process Design Package), which should enable the construction of its first production unit, as well as future plants operated under license. With regards to the core of Carbios’ process, more than 10 batches of depolymerization of PET waste have been carried out at the demonstration facility with an excellent productivity showing depolymerization kinetics and yields identical to those achieved in the Pilot facility.

- First samples of bottles produced with the Company’s PET Consortium

In June 20217, Carbios and its partners within its PET Consortium – L’Oréal, Nestlé Waters, PepsiCo et Suntory Beverage & Food Europe – announced the successful production of the first samples of food grade PET plastic bottles produced entirely from enzymatically recycled plastic, a world first. Based on the use of Carbios’ enzymatic PET recycling technology, each Consortium company has successfully manufactured sample bottles for some of their leading products including: Biotherm®, Perrier®, Pepsi Max® and Orangina®.

- R&D partnership with Michelin

In April 20218, Carbios and Michelin, a leader in sustainable mobility, announced a major step towards developing 100 % sustainable tires. By obtaining highly technical fibers from used PET plastics that meet the performance requirements for use in tires, Carbios and Michelin achieved a world first and demonstrated the full extent of the enzymatic recycling process designed and developed by Carbios.

- R&D development in textiles

In March 20229, Carbios announced the validation of the 3rd and final technical step of the research project CE-PET co-financed by ADEME10. The work carried out by Carbios and its academic partner TWB within this project has enabled the production at a pilot scale of a white PET fiber that is 100 % enzymatically recycled from colored textile waste. The Company received €827,200 (€206,800 in grants and €640,400 in repayable advances) for this validation of the C-ZYME™ process of Carbios for the sustainable recovery of textile waste.

- A strengthened financial structure to support the Group’s development

In May 202111, Carbios announced the successful completion of a capital increase without shareholders’ preferential subscription rights by way of a public offering and with a priority subscription period. The Company issued 3,000,000 new ordinary shares with a nominal value of €0.70 each, at a price of €38 per share, including issue premium, for a total amount of €114 million, representing 36.7 % of the Company’s share capital. Strategic shareholders: L’Oréal, through its venture arm BOLD (Business Opportunities for L’Oréal Development) and Michelin Ventures, subscribed to the Offering in accordance with the commitments they had made, for a total amount of €11,4 million. L’Occitane Group also subscribed for an amount of €10 million. These supports, along with the strong demand expressed by international institutional investors and individuals eligible to the public offering, underlines the strength the Company and its management team has gained. This capital increase, which has attracted strong support from investors, also contributes to the international diversification of Carbios’ shareholder base and is a significant step forward towards supporting the Company’s development.

In November 202112, Carbios announced that, together with its partners T. EN Zimmer GmbH and Deloitte, it had obtained a European funding of € 3.3 million (of which €3 million for Carbios) in the form of a grant. This support from the European Commission to Carbios’ project has been granted through the European LIFE funding program that supports innovative solutions with low environmental impact and a track record of industrial deployment.

In December 202113, Carbios announced the signing of a €30 million loan with the European Investment Bank (EIB) supported by the European Commission InnovFin Energy Demonstration Programme. This loan, disbursed in one single tranche by the EIB, carries a fixed annual interest of 2,5%, with a maturity of 8 years. This agreement is supplemented by a warrants’ issuance agreement where Carbios will issue 2.5% of the fully diluted share capital in warrants to the benefit of the EIB, of which 1.25% with an exercise price of EUR 40 per share, and 1.25% with an exercise price of EUR 38.8861 per share, corresponding to the volume-weighted average of the trading price of an ordinary Share of the Company over the last three (3) Trading Days preceding the fifth (5) day prior to the Signing Date. The creation and issuance of these EIB warrants, and therefore the disbursement of the €30 million loan, received the Company’s shareholders’ approval during the extraordinary shareholders’ meeting that took place on February 2, 2022.

- Corporate update

Evolution of the Board of Directors:

At its General Meeting dated June 23, 2021, Mrs. Mieke JACOBS and Mr. Vincent KAMEL, as well as the Companies Business Opportunities for L’Oréal Development (BOLD) and Michelin Ventures, were appointed members of the Board of the Company, for a duration of four years, expiring at the term of the Annual General Meeting to be held in 2025 and which will be called to approve the financial statements for the year ended December 31, 2024.

On March 31, 2022, the Company’s Board of Directors, following Ian Hudson’s decision to step down, unanimously chose Dr. Philippe Pouletty, co-founder of Carbios through its venture capital fund Truffle Capital, and Non-Executive Director of the Company, to be appointed as Chairman of the Board of Directors.

Philippe Pouletty succeeds Ian Hudson as Chairman of Carbios’ Board of Directors and takes on his new position on April 1st, 2022.

Philippe Pouletty declares: “On behalf of all Board members, I would like to thank Ian Hudson for his commitment in Carbios’ development and for the remarkable work achieved since 2019 to engage a true circular economy for plastics and textiles.

Contacts

Company & Media:

Carbios: Benjamin Audebert / Laura Perrin / Agnès Mathé contact@carbios.com +33 (0)4 73 86 51 76

Media Relations (Europe): Tilder Marie-Virginie Klein mv.klein@tilder.com +33 (0)1 44 14 99 96

Media Relations (U.S.): Rooney Partners Kate L. Barrette kbarrette@rooneypartners.com +1 212 223 0561