Researcher Long Chen, from the Cheung Kong Graduate School of Business, and Institute of Internet Finance, Peking University, presents a paper that stresses the importance of financial technologies to serve real life better. The author points out that Fintech has grown much faster in China than in the United States. In China, this success has come not from an initial technology advantage, but from integration between finance and real-life needs. His article, based on the Chines experience, has important implications for understanding financial innovations, and for the development of inclusive finance.

Fintech refers to innovative financial services or products delivered via technology. Fintech has become a buzzword among Wall Street investors and Silicon Valley entrepreneurs, and its investment is the fastest-growing segment in the technology industry. According to the Fintech 100 report by KPMG and H2 Ventures in 2016, more than half of the top 50 Fintech “unicorns” were born after 2010. The question presented by the author is the following one: how should we perceive these Fintech companies? Is their development comparable in different regions? Does the booming Fintech trend in the developed world imply what will happen in China, or will China take a distinctive path?

Many financial studies focus on the trade-off between risk and returns as if we live in a financially mature world. In practice, practitioners care about how to make innovations successful; policy makers care about how to promote financial innovations to support economic growth; and regulators care about the balance between the risk and benefits of innovations.

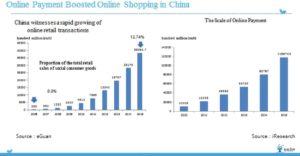

In the article, Prof. Chen documents the rapid growth of Fintech in China. Although the concepts and business models were usually initially born outside China, in terms of the number of customers and the amount served, China’s Fintech coverage has been a lot higher than that of the United States in almost all areas, including payment, wealth management, financing, and others.

He then argues that China’s success came not from initial technology advancement, but, enabled by technology, from a much better integration between finance and real-life scenarios, a phenomenon he calls scenarization of finance. Scenarization promotes a virtuous circle among technology, finance, and real-life needs. If the concept of Fintech emphasizes the importance of technology enabling finance, then “finlife,” emphasizing the importance of finance serving real life, seems more appropriate for Fintech’s growth path.

Put differently, the success of Fintech should start with technology, but end with trust and usage in real life. Such analysis is not only important for understanding financial innovation, but also useful for the development of inclusive finance, given how rapidly consumers can obtain access to finance through new technology. The rest of the article proceeds as follows. Section 2 documents the rapid growth of Fintech in China. Section 3 uses the case of Ant Financial, the leading Fintech company in China, to explore why Fintech has grown so fast. Sections 4 and 5 discuss the concept of scenarization and its implications for financial inclusion. Section 6 discusses the implications for government policy and regulation.

Read the full article at: http://www.tandfonline.com/doi/pdf/10.1080/17538963.2016.1215057