Record GAAP and Adjusted Revenue for Fourth Quarter and Full Year 2021

Fourth Quarter $286 Million GAAP Revenue Up 67%, $280 Million Adjusted Revenue Up 54% Year-over-Year

Fourth Quarter Adjusted EBITDA of $5 Million Positive for 6th Straight Quarter

Record 523,000 Quarterly New Member Adds Up 39% Sequentially

Record 906,000 Quarterly New Product Adds Up 51% Sequentially

SAN FRANCISCO–(BUSINESS WIRE)–$SOFI–SoFi Technologies, Inc. (NASDAQ: SOFI), a member-centric, one-stop shop for digital financial services that helps members borrow, save, spend, invest and protect their money, reported financial results today for its fourth quarter and fiscal year ended December 31, 2021.

“We hit new highs across our key financial and operating metrics in the fourth quarter, finishing 2021 with record annual results,” said Anthony Noto, CEO of SoFi Technologies, Inc. “Adjusted net revenue of $280 million was another quarterly record for us, up 54% year-over-year and up sequentially, even with the unexpected extension of the federal student loan payment moratorium in late December. We exceeded $1 billion in annual adjusted net revenue for the first time. We also delivered fourth quarter adjusted EBITDA of $5 million — our sixth consecutive positive quarter — resulting in positive full-year adjusted EBITDA of $30 million. The best part is that we were able to reach both our adjusted revenue and adjusted EBITDA milestones ahead of plan in an increasingly challenging operating environment, while also significantly exceeding our member growth guidance.”

Consolidated Results Summary

|

|

|

Three Months Ended December 31, |

|

% Change |

|

Year Ended December 31, |

|

% Change |

||||||||||||||

|

($ in thousands) |

|

|

2021 |

|

|

|

2020 |

|

|

|

|

2021 |

|

|

|

2020 |

|

|

||||

|

Consolidated – GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Total net revenue |

|

$ |

285,608 |

|

|

$ |

171,491 |

|

|

67 |

% |

|

$ |

984,872 |

|

|

$ |

565,532 |

|

|

74 |

% |

|

Net loss |

|

|

(111,012 |

) |

|

|

(82,616 |

) |

|

34 |

% |

|

|

(483,937 |

) |

|

|

(224,053 |

) |

|

116 |

% |

|

Loss per share – basic and diluted |

|

$ |

(0.15 |

) |

|

$ |

(1.85 |

) |

|

|

|

$ |

(1.00 |

) |

|

$ |

(4.30 |

) |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Consolidated – Non-GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Adjusted net revenue(1) |

|

$ |

279,876 |

|

|

$ |

182,019 |

|

|

54 |

% |

|

$ |

1,010,325 |

|

|

$ |

621,207 |

|

|

63 |

% |

|

Adjusted EBITDA(1) |

|

|

4,593 |

|

|

|

11,817 |

|

|

(61 |

) % |

|

|

30,221 |

|

|

|

(44,576 |

) |

|

n/a |

|

___________________

|

(1) |

Adjusted net revenue and adjusted EBITDA are non-GAAP financial measures. For more information and reconciliations to the most comparable GAAP measures, see “Non-GAAP Financial Measures” and Table 2 to the “Financial Tables” herein. |

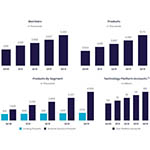

Noto continued: “As important, we also reached all-time highs in members added, products added and engagement as well. We finished 2021 with approximately 3.5 million total SoFi members, up 87%, or 1.6 million, from where we started the year, and approximately 500,000 ahead of our stated goal. We added a record 523,000 new members in the fourth quarter — a new high in absolute number terms, up 39% versus the number of net adds in Q3 2021. We also extended our string of triple-digit year-over-year product growth for the sixth consecutive quarter, adding 906,000 new products, up 51% versus the number of net adds in the third quarter, to end 2021 with a record 5.2 million products in total, more than 2.6 million, or 105%, higher from where we started the year. We were able to achieve these milestones in 2021 — and get to such a position of strength today — for three main reasons: First, we continued to drive strong growth through great execution across our three diverse businesses, as we adapted to capitalize on changing macro conditions. Second, the success of our unique Financial Services Productivity Loop (FSPL) strategy accelerated as we scaled our business in 2021 — allowing us to exceed our original 2021 member growth target by 40% and still hit our adjusted EBITDA target. And third, we took a giant step forward in 2021 in achieving our goal of becoming a household brand name by investing in and growing our brand awareness via our SoFi Stadium affiliation, the success of our integrated multi-media campaigns and the virality of the influencers with whom we partnered.”

Noto concluded: “Today, SoFi is in its strongest position ever to differentiate our offerings and ensure that we’re delivering for our members and enhancing their experience with each new product they adopt. Our new bank charter will be a game changer for us in differentiating our SoFi Checking and Savings offering in the marketplace, and improving our pricing and selection across Lending. Acquiring Technisys, a leading cloud-native, digital multi-product core banking platform, will be a critical next step in our continued efforts to vertically integrate SoFi’s businesses to further accelerate the pace of innovation of our best-of-breed financial products. We expect Technisys to be a growth multiplier for both SoFi and Galileo, in addition to realizing its own enormous growth opportunities, which are further strengthened in partnership with Galileo. We think we are well on our way to building the AWS of fintech. We have the right strategy, offering, leadership, liquidity and people to achieve our long-term strategic goal to be the digital one-stop shop for our members for all of the major financial decisions in their lives, and all of the moments in between. Having just celebrated my fourth anniversary as CEO of SoFi in February, I could not be more excited about what’s ahead, and I feel like we are just getting started.”

Consolidated Results

Total GAAP net revenue of $285.6 million in the fourth quarter of 2021 and $984.9 million for full-year 2021 increased 67% and 74%, respectively, from the corresponding prior-year periods of $171.5 million and $565.5 million, respectively. On an adjusted basis, net revenue of $279.9 million for the fourth quarter and $1.01 billion for the full year were up 54% and 63%, respectively, from the corresponding prior-year period totals of $182.0 million and $621.2 million, respectively. Strength in all three of SoFi’s business segments drove the year-over-year growth in these measures.

SoFi recorded a GAAP net loss of $111.0 million for the fourth quarter of 2021 and $483.9 million for full-year 2021, versus the prior-year periods’ net losses of $82.6 million and $224.1 million, respectively. Fourth quarter adjusted EBITDA of $4.6 million was positive for the sixth consecutive quarter, culminating in full-year positive adjusted EBITDA of $30.2 million.

Member and Product Growth

SoFi added a record number of both members and products in absolute terms for the quarter and year. The SoFi Stadium affiliation, together with successful integrated marketing and influencer campaigns, took brand recognition to new highs, which SoFi leveraged through better execution of its unique Financial Services Productivity Loop (FSPL) strategy.

The five nationally televised NFL regular season games at SoFi Stadium were seen by an average of more than 22 million households per game, for 110 million-plus household impressions in total. This visibility helped to increase SoFi’s unaided brand awareness by nearly 70% in 2021, which reached a new record in the fourth quarter. SoFi unaided brand awareness rose again in February 2022, when an estimated 106 million people watched the Los Angeles Rams win the Super Bowl at home at SoFi Stadium.

These brand-building strategies, coupled with referral and cross-buy campaigns such as Refer the App, the SoFi Money Referral program, the SoFi Money-Personal Loan bundle, and SoFi’s unique rewards program, drove record new member and product additions. SoFi added approximately 523,000 new members in the fourth quarter – a record in absolute number terms and up 39% from the approximately 377,000 new members added in the third quarter, to finish 2021 at 3.5 million, up 1.6 million, or 87%, from 2020.

Total products added in the fourth quarter of approximately 906,000 were 51% higher than the approximately 600,000 added in the third quarter, and up 105% year-over-year, for SoFi’s sixth consecutive quarter of triple-digit growth. Total products of nearly 5.2 million at year-end were more than double the 2.5 million at year-end 2020. With product growth exceeding member growth in absolute terms, members are demonstrating high product satisfaction and greater willingness to adopt additional products, further reinforcing the value of SoFi’s unique FSPL strategy.

|

(1) |

Beginning in the fourth quarter of 2021, the Company included SoFi accounts on the Galileo platform-as-a-service in its total Technology Platform accounts metric to better align with presentation of Technology Platform segment revenue. The Company recast the total accounts as of December 31, 2020 to conform to the current year presentation, which resulted in an increase of 375,367 in total accounts as of such date. Quarterly amounts for the relevant quarters in 2021 and 2020 were determined to be immaterial, and as such were not recast. |

In the Financial Services segment, total products increased by 155% year-over-year, to 4.1 million from 1.6 million, driven primarily by growth in SoFi Invest and SoFi Money offerings.

Lending products rose 18% in the fourth quarter, and were up across all loan types. Record demand for personal loans was the largest driver, followed by an increase in demand for student loans in the lead-up to the anticipated January 2022 expiration of the moratorium on federal student loan payments.

With the rapid growth in Financial Services products, SoFi finished 2021 with nearly four times as many of these high-frequency, low acquisition cost, “top-of-funnel” products as low-frequency, high lifetime value (LTV), “bottom-of-funnel” Lending products. With these “top-of-funnel” offerings driving product growth, total company fourth quarter cross-buy volume — the term for when existing SoFi members acquire an additional SoFi product — more than tripled year-over-year, to SoFi’s highest absolute number of cross-bought products ever.

Technology Platform enabled accounts increased by 67% year-over-year to 99.7 million, due to both diverse new client additions and growth among existing Galileo clients.

Lending Segment Results

Lending segment GAAP and adjusted net revenues were $213.8 million and $208.0 million, respectively, for the fourth quarter of 2021, and $738.3 million and $763.8 million, respectively, for the full year. This represented quarterly year-over-year increases of 43% and 30%, respectively, and full year increases of 54% and 42%, respectively, driven by growth in net interest income, and origination and gain on sale revenue.

Lending segment contribution profit of $105.1 million, at a 51% margin of adjusted Lending net revenue for the fourth quarter of 2021, increased 23% year-over-year, but declined sequentially from the third quarter’s $117.7 million of contribution profit at a 55% margin. This sequential decline was primarily due to lower home loan conversion at SoFi’s third-party fulfillment partner in home loans, which reduced SoFi’s ability to meet strong home loans demand. These issues have since been resolved by the onboarding of another third-party fulfillment partner. Additionally, higher student loan refinancing marketing spend to drive volume in the lead-up to the January 2022 federal student loan payment moratorium expiration was not recouped when the moratorium was extended in late-December, curtailing demand during the final week of the quarter. Full-year Lending segment contribution profit of nearly $400 million was up 65%, at a 52% margin.

|

Lending – Segment Results of Operations |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Three Months Ended December 31, |

|

|

|

Year Ended December 31, |

|

|

||||||||||||||

|

($ in thousands) |

|

|

2021 |

|

|

|

2020 |

|

|

% Change |

|

|

2021 |

|

|

|

2020 |

|

|

% Change |

||

|

Total net revenue – Lending |

|

$ |

213,764 |

|

|

$ |

148,992 |

|

|

43 |

% |

|

$ |

738,323 |

|

|

$ |

480,866 |

|

|

54 |

% |

|

Servicing rights – change in valuation inputs or assumptions |

|

|

(9,273 |

) |

|

|

1,127 |

|

|

(923 |

)% |

2,651 |

|

|

|

17,459 |

|

|

(85 |

) % |

||

|

Residual interests classified as debt – change in valuation inputs or assumptions |

|

|

3,541 |

|

|

|

9,401 |

|

|

(62 |

) % |

|

|

22,802 |

|

|

|

38,216 |

|

|

(40 |

) % |

|

Directly attributable expenses |

|

|

(102,967 |

) |

|

|

(74,316 |

) |

|

39 |

% |

|

|

(364,169 |

) |

|

|

(294,812 |

) |

|

24 |

% |

|

Contribution Profit |

|

$ |

105,065 |

|

|

$ |

85,204 |

|

|

23 |

% |

|

$ |

399,607 |

|

|

$ |

241,729 |

|

|

65 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Adjusted net revenue – Lending(1) |

|

$ |

208,032 |

|

|

$ |

159,520 |

|

|

30 |

% |

|

$ |

763,776 |

|

|

$ |

536,541 |

|

|

42 |

% |

_________________

| (1) |

Adjusted net revenue – Lending represents a non-GAAP financial measure. For more information and a reconciliation to the most comparable GAAP measure, see “Non-GAAP Financial Measures” and Table 2 to the “Financial Tables” herein. |

Fourth quarter Lending segment total origination volume increased 67% year-over-year, with record volume in personal loan originations and higher student loan originations more than offsetting the decline in home loan volume.

Record personal loan originations of more than $1.6 billion in the fourth quarter of 2021 were up $1.0 billion, or 168%, year-over-year, and more than double fourth quarter 2019’s pre-pandemic total. SoFi’s personal loans business outperformed due to improved execution, technology and credit model enhancements, a reopening of personal loan credit eligibility and continued strong demand for its high-quality loans. Full-year personal loan originations of more than $5.3 billion were more than double the 2020 total and 44% above 2019’s pre-Covid level. In addition, providing loan referral fulfillment services to Pagaya, an artificial intelligence (AI) network that facilitates credit decisioning, enabled SoFi to access a broader audience to drive further growth in personal loans without taking additional underwriting risk.

In the fourth quarter, student loans benefited from accelerating demand ahead of the January federal student loan payment moratorium deadline and anticipated rate increases in 2022. Student loan originations of nearly $1.5 billion increased 51% sequentially – even with the unexpected late-December extension of the federal student loan payment moratorium to May 2022. This suggests there may be a rapid return to pre-pandemic student loan demand levels once the payment moratorium expires.

|

Lending – Originations and Average Balances |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Three Months Ended December 31, |

|

% Change |

|

Year Ended December 31, |

|

% Change |

||||||||||

|

|

|

2021 |

|

2020 |

|

|

2021 |

|

2020 |

|

||||||||

|

Origination volume ($ in thousands, during period) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Home loans |

|

$ |

657,304 |

|

$ |

672,724 |

|

(2 |

) % |

|

$ |

2,978,222 |

|

$ |

2,183,521 |

|

36 |

% |

|

Personal loans |

|

|

1,646,289 |

|

|

613,774 |

|

168 |

% |

|

|

5,386,934 |

|

|

2,580,757 |

|

109 |

% |

|

Student loans |

|

|

1,461,405 |

|

|

970,543 |

|

51 |

% |

|

|

4,293,526 |

|

|

4,928,880 |

|

(13 |

) % |

|

Total |

|

$ |

3,764,998 |

|

$ |

2,257,041 |

|

67 |

% |

|

$ |

12,658,682 |

|

$ |

9,693,158 |

|

31 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Average loan balance ($, as of period end)(1) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Home loans |

|

$ |

286,991 |

|

$ |

291,382 |

|

(2 |

) % |

|

|

|

|

|

|

|||

|

Personal loans |

|

|

22,820 |

|

|

21,789 |

|

5 |

% |

|

|

|

|

|

|

|||

|

Student loans |

|

|

50,549 |

|

|

54,319 |

|

(7 |

) % |

|

|

|

|

|

|

|||

_________________

|

(1) |

Within each loan product category, average loan balance is defined as the total unpaid principal balance of the loans divided by the number of loans that have a balance greater than zero dollars as of the reporting date. Average loan balance includes loans on the balance sheet and transferred loans with which SoFi has a continuing involvement through its servicing agreements. |

|

|

|

December 31, |

|

|

|||

|

Lending – Products |

|

2021 |

|

2020 |

|

% Change |

|

|

Home loans |

|

23,035 |

|

13,977 |

|

65 |

% |

|

Personal loans |

|

610,348 |

|

501,045 |

|

22 |

% |

|

Student loans |

|

445,569 |

|

402,623 |

|

11 |

% |

|

Total lending products |

|

1,078,952 |

|

917,645 |

|

18 |

% |

Technology Platform Segment Results

SoFi’s Technology Platform segment consists primarily of Galileo Financial Technologies, LLC (Galileo), a technology infrastructure provider acquired in May 2020. Galileo signed nine new clients during the fourth quarter, for a full year 2021 total of 44. Client accounts enabled by Galileo rose 67% year-over-year, to approximately 100 million from approximately 60 million, through new client acquisition and growth at existing clients. Galileo has also expanded its client base to include B2B and enterprise clients, as adoption of modern digital payments and banking has opened up new verticals, client types, use cases and opportunities.

|

|

|

December 31, |

|

|

||

|

Technology Platform |

|

2021 |

|

2020 |

|

% Change |

|

Total accounts |

|

99,660,657 |

|

59,735,210 |

|

67 % |

Technology Platform segment net revenue of $53.3 million for the fourth quarter of 2021, and $194.9 million for the full year, was up 42% and 102%, respectively, from the comparable prior year periods. SoFi continues to invest heavily to capture Galileo’s significant and accelerating secular growth opportunities. This intentional increased investment drove quarterly Galileo operating expenses 61% higher year-over-year, and lowered the contribution margin from 45% to 38% in the fourth quarter. Maintaining this high level of investment for sustained, long-term growth is expected to require operating the business at a 20–30% contribution margin range for the foreseeable future.

|

Technology Platform – Segment Results of Operations |

|

|

|

|

|

|

||||||||||||||||

|

|

|

Three Months Ended December 31, |

|

|

|

Year Ended December 31, |

|

|

||||||||||||||

|

($ in thousands) |

|

|

2021 |

|

|

|

2020 |

|

|

% Change |

|

|

2021 |

|

|

|

2020 |

|

|

% Change |

||

|

Total net revenue |

|

$ |

53,299 |

|

|

$ |

37,482 |

|

|

42 |

% |

|

$ |

194,886 |

|

|

$ |

96,316 |

|

|

102 |

% |

|

Directly attributable expenses |

|

|

(33,291 |

) |

|

|

(20,676 |

) |

|

61 |

% |

|

|

(130,439 |

) |

|

|

(42,427 |

) |

|

207 |

% |

|

Contribution Profit |

|

$ |

20,008 |

|

|

$ |

16,806 |

|

|

19 |

% |

|

$ |

64,447 |

|

|

$ |

53,889 |

|

|

20 |

% |

Financial Services Segment Results

Fourth quarter 2021 net revenue of nearly $22.0 million was more than five times the prior year period’s total of $4.1 million, demonstrating SoFi’s rapid progress in monetizing this segment. The Financial Services segment contribution loss of $35.2 million improved by $1.6 million from the prior year quarter’s $36.8 million loss, due to the benefits of ongoing investments for growth. For the full year, the segment delivered $58.1 million of revenue, a nearly five-fold increase from the prior year’s $11.9 million total, and the $134.9 million contribution loss was essentially flat versus $132.1 million in the prior year period.

|

Financial Services – Segment Results of Operations |

|

|

|

|

|

|

||||||||||||||||

|

|

|

Three Months Ended December 31, |

|

|

|

Year Ended December 31, |

|

|

||||||||||||||

|

($ in thousands) |

|

|

2021 |

|

|

|

2020 |

|

|

% Change |

|

|

2021 |

|

|

|

2020 |

|

|

% Change |

||

|

Total net revenue |

|

$ |

21,956 |

|

|

$ |

4,051 |

|

|

442 |

% |

|

$ |

58,078 |

|

|

$ |

11,870 |

|

|

389 |

% |

|

Directly attributable expenses |

|

|

(57,145 |

) |

|

|

(40,804 |

) |

|

40 |

% |

|

|

(192,996 |

) |

|

|

(143,966 |

) |

|

34 |

% |

|

Contribution loss |

|

$ |

(35,189 |

) |

|

$ |

(36,753 |

) |

|

(4 |

) % |

|

$ |

(134,918 |

) |

|

$ |

(132,096 |

) |

|

2 |

% |

By continuously innovating for members with new and relevant offerings, features and rewards, SoFi added approximately 2.5 million Financial Services products in 2021, bringing the total to approximately 4.1 million. Triple-digit growth in SoFi Money and SoFi Invest products were the largest drivers of the 155% year-over-year increase in total Financial Services products. New SoFi Money features in 2021 include two-day early paycheck, autosave, cashback, and no-fee overdraft protection. SoFi’s new SoFi Checking and Savings offering is truly differentiated in the category, with a 1% annual percentage yield for direct deposit members — 33 times the national average — and no minimum balance requirements, plus many of the free features SoFi Money members historically enjoyed.

SoFi Invest expanded member selection in both cryptocurrencies and retail IPOs in 2021. Two new crypto coin additions in the fourth quarter brought the full-year total added to 25, and the year-end total of 30 placed SoFi among the selection leaders in the space. SoFi Invest also brought two regular-way IPOs to members in the fourth quarter — as the primary retail channel for Rivian, the largest IPO since Facebook in 2012, and Nubank, a leading fintech company in Brazil. SoFi introduced stop-limit trade orders in the fourth quarter as well, and added margin trading in the first quarter of 2022. The SoFi Credit Card — with a unique Rewards platform that awards points for both transactions and smart financial behaviors — experienced strong take-up in its first full year. Total accounts grew from approximately 6,000 to more than 91,000 from the beginning through the end of 2021, and quarterly spend, balances and accounts averaged high double-digit growth throughout the year. In addition, SoFi’s partnership with Pagaya resulted in nearly 7,700 referred loans, a promising debut in its first full quarter.

|

|

|

December 31, |

|

|

||

|

Financial Services – Products |

|

2021 |

|

2020 |

|

% Change |

|

Money |

|

1,436,955 |

|

645,502 |

|

123 % |

|

Invest |

|

1,595,143 |

|

531,541 |

|

200 % |

|

Credit Card |

|

91,216 |

|

6,445 |

|

n/m |

|

Referred loans |

|

7,659 |

|

— |

|

n/m |

|

Relay |

|

930,181 |

|

408,735 |

|

128 % |

|

At Work |

|

33,091 |

|

13,687 |

|

142 % |

|

Total products |

|

4,094,245 |

|

1,605,910 |

|

155 % |

Subsequent Events

National Bank Charter Approval

A key element of SoFi’s long-term strategy has been to secure a national bank charter. In January 2022, SoFi received regulatory approval to become a bank holding company and to acquire Golden Pacific Bancorp, Inc., and its wholly-owned subsidiary, Golden Pacific Bank, National Association, a national bank (“Golden Pacific Bank”) (such acquisition, the “Bank Merger”). SoFi also received approval to change the composition of Golden Pacific Bank’s assets. The Bank Merger closed in February 2022, after which SoFi became a bank holding company and Golden Pacific Bank began operating as SoFi Bank.

Management’s view is that operating as a bank holding company can enhance SoFi’s overall profitability. Management believes that moving from a reliance on third-party bank holding companies by operating under a national bank charter will allow SoFi to provide current and prospective members broader and more competitive options across their financial services needs, including deposit accounts and loan products, while lowering the overall cost to fund loans (by utilizing members’ deposits held at SoFi Bank instead of third parties to fund loans). This is expected to enable SoFi to offer lower interest rates on loans to members, as well as competitive interest rates on SoFi Checking and Savings accounts that elect direct deposit, without having to charge non-interest based fees. With the Bank Merger complete, SoFi has begun to transfer SoFi Money products to SoFi Bank, and intends to continue to transfer its Lending, SoFi Money and SoFi Credit Card products to SoFi Bank over time.

Technisys Acquisition

On February 22, 2022, SoFi Technologies, Inc. announced that it had entered into an agreement and plan of merger (the “Merger Agreement”) to acquire Technisys, a leading cloud-native, digital multi-product core banking platform, at a transaction value of approximately $1.1 billion. Technisys’ shareholders will receive a base consideration of approximately 84 million shares, subject to customary adjustments set forth in the terms of the Merger Agreement. The transaction is subject to satisfaction of certain closing conditions.

Management believes the acquisition of Technisys will provide a critical strategic asset, as both an attractive business, and an innovative technology advancing SoFi’s effort to build the AWS of Fintech and its ambition to provide best-of-breed products on a one-stop shop platform that meets all of its members’ financial needs. In management’s view, combining Technisys’ Cyberbank platform with Galileo will create one of the most modern full-stack offerings available with multi-product capabilities — including deposit, checking, lending, credit cards and investing as well as future products — all surfaced through industry-leading APIs. In addition, it is believed that the growth opportunities of both Galileo and Technisys will expand meaningfully as a result of gaining access to each company’s large installed client base.

Contacts

Investors:

Andrea Prochniak

SoFi Investor Relations

aprochniak@sofi.com

Media:

Rachel Rosenzweig

SoFi Media Relations

rrosenzweig@sofi.com