Banking is a technology business at its very core. Other than the financial shocks and repercussions of the unprecedented COVID-19 pandemic, nothing has shaped the banking industry more in the past decade than developments in financial technology (fintech).

To learn more about commercial banking digitization and the shifting focus of banks, PaymentsJournal sat down with Sanat Rao, Chief Business Officer at Infosys Finacle and Steve Murphy, Director of Commercial and Enterprise Payments Advisory Service at Mercator Advisory Growth.

Corporate banking technology is expanding

“Investors have reacted to advancements in fintech with open pockets, as indicated by the nearly $200 billion in venture capital funding in the fintech sector since 2014,” began Murphy. Though early investments were primarily targeted towards consumer solutions, they have since expanded to include a larger number of enterprise and corporate banking capabilities.

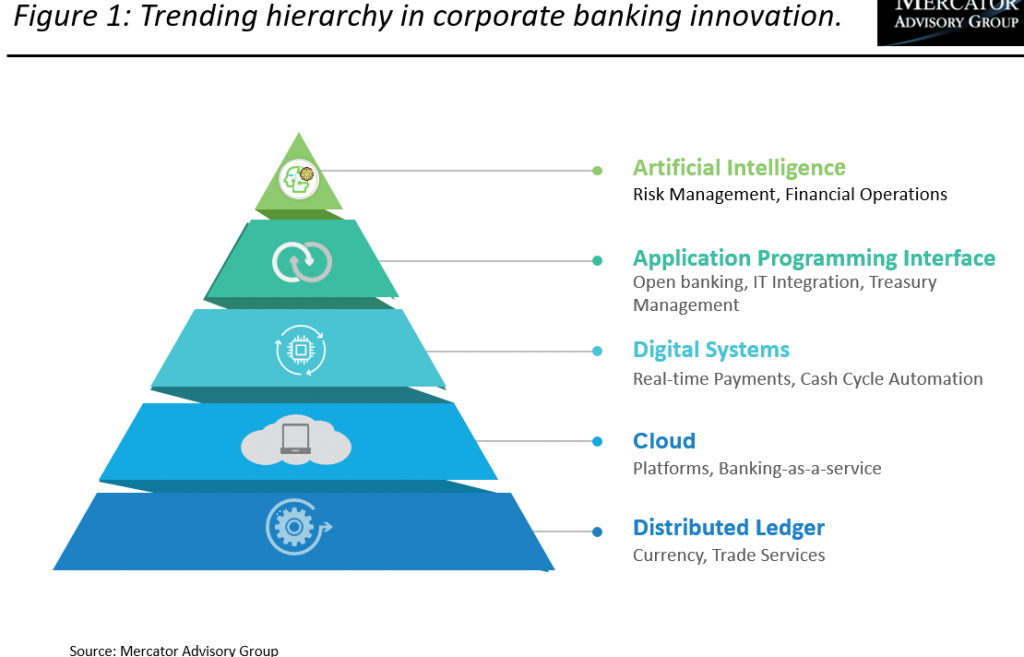

The chart below, provided by Mercator Advisory Group, presents a hierarchy of emerging technologies and categories that have been opening up on the enterprise level:

Artificial intelligence (AI), particularly machine learning (ML), is largely being used for operational enhancements such as credit granting and fraud control capabilities. Meanwhile, application program interfaces (APIs) have become a staple in the integration of new products and services. Similarly, cloud and blockchain adoption are noteworthy aspects of the ongoing digitalization as banks modernize every system across the cash cycle.

While the digital shift was occurring well before to COVID-19, the pandemic has heightened the urgency for banks of all sizes to make the digital shift and improve the customer experience.

Customers are using the same products in new (digital) ways

“Technology has absolutely been at the forefront of all the changes we have seen and will see in upcoming years,” explained Rao. Even so, the business of banking has not changed on a fundamental level. Rather, products have become more commoditized; similar business products are being offered, but customers are using them in different ways. In Rao’s words, “the ‘what’ component has not changed, but the ‘how’ has.”

This is where digitization has had the biggest impact. For example, commercial banking capabilities like making a payment or collecting a receivable have long been available for corporate entities. But today, the same capability can be offered in a way that emphasizes a great user experience—something that hasn’t always been a focal area in the commercial banking space.

This trend of offering old business products in a completely new way is one that is expected to gain momentum. Banks will keep making efforts to create intelligent experiences for customers, which is reflected in recent investments flowing towards customer-oriented technology offerings and information reporting.

Small and large banks face different technology challenges

Large traditional banks are frequently riddled with outdated legacy systems on the back end of operations, which dilutes their offerings even with modern digital technology at the front end. These legacy systems make it costly to create the ideal customer experience, leading many banks to focus on implementing strategies that pave the path towards modernization. In certain cases, this means opening up and modernizing selective pieces of back-end systems to improve operations overall.

Smaller banks, on the other hand, tend to be dependent on mass vendors—they simply don’t have the financial and technological might needed to successfully take on big banks and their comprehensive IT teams. These small banks often require external partners that can provide technological support that prevents growing clients from migrating to top tier banks for cash management services. A downside to that, noted Rao, is that banks become “bound by the framework and methodology adopted by solution partners.”

Critical focus areas for banks in the commercial space

1. Open banking

Even though open banking is driven by regulations, it is fostering a significant amount of innovation that has benefited commercial banking customers. This is unusual because in most cases, innovation tends to attract regulations around it. In this case, however, already existing regulation triggered a wave of innovation.

While open banking is mandated in Europe, that isn’t the case in the United States. In the U.S., banks have begun to create API channels for corporate clients. Services such as balance inquiries and loan drawdowns can be done through APIs, making bank systems and their clients more interactive with one another. Further, “there will be more end-to-end data available for improved decision making, instead of data residing in silos like today,” said Rao.

2. Fintechs

Fintechs used to be largely viewed as a threat to financial institutions, but banks now realize that they also come with opportunities for some unique partnerships. Competitive fintechs can collaborate with banks to create agile, innovative customer-centric ecosystems and offer customers the banking services and experience they need to be satisfied. In particular, fintechs are effective at solving problems in their specific niche area.

3. Payments

Payments has been a major area of disruption in recent years as the world moves to digital transactions, blockchain is deployed to reduce transaction costs, real-time and cross-border payments expand, and other payments innovations are developed.

While banks have traditionally relied on internal payment hubs for transaction processing, many of these internal hubs are not equipped with the data management capabilities needed to provide a high level of transaction visibility at a low cost. Moving forward, said Rao, “payments as a service (PaaS) is something that will be embraced by all players and consumers, and will be an area that banks really focus in on.”

4. SMEs

Corporate banks supporting small to medium enterprises (SMEs) could once offer watered down versions of the products designed for large corporate customers. Today—especially in the world of COVID-19—banks need to know that SMEs expect automation, customer service, and digital processes. If their unique needs are not met, SMEs will turn to larger banks for their expanded ability to automate and digitize.

Conclusion

The digital transformation is quickly reshaping what services look like in the commercial banking space. While many of the services offered by banks today are similar to those in previous years, they are now fueled by technological capabilities that prioritize the customer experience and address the needs of small and large corporate clients.

As more aspects of banking are digitized, banks will increase their focus on several key development areas, including open banking, fintechs, payments, and SMEs. Looking forward, banks can be expected to invest heavily in creating industry-specific expertise, leverage data and analytics to improve the customer experience, and move towards cloud deployment to remain relevant in an increasingly competitive environment.

“The expectation is that the digital adoption is going to accelerate, so banks have to update their processes and be better prepared for the future,” concluded Rao.