Just 30 years ago, you would have to wait days for a bank to approve your credit. Or spend weeks bogged down by your insurance company’s bureaucracy just to get a refund after a minor car accident. Today, these operations take less than a day as documents are submitted and processed online with little or no human interaction. In this article, we’ll cover a set of technologies that promise to transform the whole idea of doing business in the finance world.

Artificial Intelligence – is it simply a trendy phrase to put on your landing page or an innovation-ready use case? The answer is…both. We, of course, will talk about real-life examples of using AI in several areas of the financial industry.

Insurance

Claims automation

A number of machine learning and text analysis based technologies allow insurance companies to automate the claims process, reducing the waiting time and freeing agents to work on less routine tasks. Recognizing human speech can help digitize claims handling. Since much of a customer service rep’s time is spent processing claims over the phone, speech recognition can help with transcribing and interpreting information. Another untapped potential is text recognition. It can help digitize handwritten notes and reports, as well as transcribe audio messages and calls in real time, using voice APIs like Google Cloud Speech-to-Text or IBM Speech to Text.

How it’s applied. IT services provider Cognizant built a solution that helped a property and casualty insurance company to transcribe claims calls in real time, creating a summary of the call that is then presented to an agent for a review. They’ve also analyzed 25,000 saved calls to identify the most common claims and activities.

An InsurTech company

Personalizati provides solutions for claims automation and fraud detection. Its SaaS product integrates with an insurer’s systems and initiates automation processes for every step of claims processing. It also generates a fraud score for each claim, creates detailed suspicion reports, and recommends investigation activities for complex cases.

By creating a personalized insurance profile for their clients, insurance companies can achieve significant results in attracting new and retaining old customers. Based on a policyholder’s historical and personal data, as well as statistics, algorithms can notice dependencies unclear to humans and the company can apply individual risk scoring for every client.

This approach is especially popular with health insurance providers: Also, personalization is related to risk and price. Those in better health with healthier lifestyles and less inclined to health risks can get discounts. While this approach raises personal data privacy concerns, Accenture research shows that 80 percent of consumers are ready to share their personal information if this leads to better service.

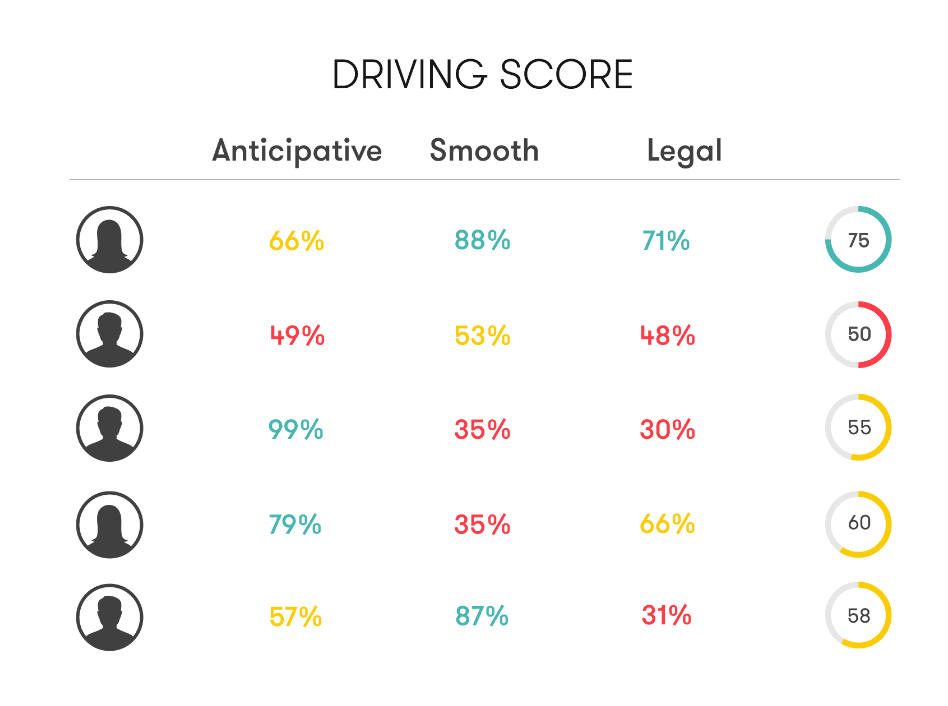

How it’s applied. Sentiance is a data science company that provides data tracking and analysis solutions for IoT, health, insurance, and commerce. They offer a mobile solution that uses smartphone sensors to track, record, analyze, and score driver behavior. Based on these inputs, it scores driving behavior, so that an insurance company can increase or reduce a client’s premium.

Driving score from Sentiance behavior intelligence platform. Source: Sentiance

BlueCross BlueShield, a health insurance company, has BCBS Axis system that helps companies tailor policies to suit their employee population, applying data about health issues. This system analyzes data on 2.3 billion health procedures from 96 percent of US healthcare institutions and professionals to help their client employers make informed decisions.

Banking

Fraud detection

Fraud remains one of the most sensitive for the financial security of customers and banks: Credit card fraud using new accounts is number one in identity theft cybercrimes. We’ve mentioned how AI algorithms can identify a fraudulent insurance claim, but the issue is more prevalent in credit card operations. As payments become more frictionless, banks can’t rely on regular rule-based fraud detection, so machine-learning-based fraud detection systems enter the stage. To know how it works, see our detailed whitepaper about ML methods used for fraud detection.

In banking, ML systems often assess data credibility by comparing paper documents with system data or using transaction history to verify a person. They also notice copies of the same transactions, distinguishing misclicks and actual scams. And one of the most common cases is detecting unusual purchases and automatically sending a verification request to a client.

How it’s applied. Mastercard uses the Vocalink solution to assess all new customer transactions at the beginning of each transaction lifecycle, preventing fraud at an early stage. Their fraud prevention solution monitors transactions and notifies financial institutions about suspicious processes that require further consideration. Besides fraud prevention, it also provides analytical reports and prevents money laundering.

Kount, a digital fraud prevention solution, offers fraud prevention services for payments and new accounts, as well as account protection. The system uses data network and advanced machine learning technologies. It also supports frictionless payments by providing detailed data about each login that’s later used to detect anomalies and correct customer experience.

Credit scoring

If done manually, credit scoring takes lots of time, because tons of different data has to be processed: personal info, income, payment history, and even credit history from another banks, which can be obtained through various financial APIs. Besides, traditional credit scoring usually requires that people are divided into a few clearly distinguishable groups, so it’s often a black-and-white situation, with not much gray area.

Most ML-based credit scoring solutions use predictive algorithms that tell whether a client will pay back or not. Besides, they may use different machine learning methods including Natural Language Processing for analyzing social media data. Having access to a larger volume of customer data, banks with AI-based credit scoring can provide credit to people who wouldn’t otherwise have access to it.

How it’s applied. Lenddo is a credit scoring provider that uses predictive algorithms and offers integration with online and mobile services. Even if a person who applies for a credit doesn’t have a credit history, this solution can provide them with a score, analyzing their digital footprint (like social media activity, geolocation, and search engine activity).

GiniMachine is a credit scoring platform that offers their services to financial institutions. They provide data analysis for scoring individuals and businesses. GiniMachine uses its own model for credit scoring, based on historic data of issued loans with status repaid and overdue. The platform analyzes data using a deep learning neural network, and then creates a report, eligible for score calculation.

Investment and Trading

Financial advisory

The financial industry is subject to various risks, especially when investing. AI technologies can help make an informed decision about investments and predict possible risks using data analytics, deep learning, and machine learning algorithms. Some of them exist as analytic platforms that apply data analysis or other solutions.

Among the emerging trends are robo-advisors. They work like the regular financial advisors. As a rule, they target investors who have limited resources and want to manage their funds, like small- and medium-sized businesses or individuals. AI-based robo-advisors create financial portfolios for their users and apply historic data processing, including risk assessment algorithms in some situations. These solutions cover the following segments:

- Investments

- Retirement plans

- Student loans

- Trading

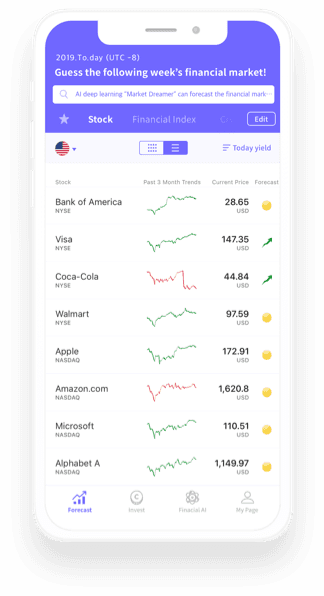

KOSHO robo-advisor interface. Source: KOSHO

How it’s applied. Robo-advisors exist in different forms. For example, Korean app KOSHO is a solution for individuals. It analyzes three key market factors (VIX, PMI, and inflation), using deep learning and historic data from the financial market.

Sentiment analysis

You can follow current market trends by scrolling news and publication all day long, hiring someone to do it for you or using sentiment analysis. This methodology analyzes text by sentences, distinguishing positive, negative, and neutral meanings. In trading, sentiment analysis tools analyze market sentiments and mentions of companies that are in an investor’s portfolio whether in the news or on social media.

How it’s applied. Sentiment analysis helps predict the trends for traders and investors, and there are solutions specifically for this market. One of the examples is Catana Capital, a tool for trading predictions that processes news articles, tweets, and blogs.

Customer experience

Chatbots

The main goal of chatbots, regardless of the industry they’re applied in, is to improve user experience. Another goal is to reduce employee workload by communicating with customers and answering their questions. In the financial industry, chatbots are mostly used as a component of front office in banks and insurance companies.

Cognizant defines an effective chatbot as one that unites three factors: communication (analyzing language), comprehension (context, mood, and location analysis), collaboration (utility and integration). There are three categories of chatbot capabilities:

- Basic chatbot – a chatbot without natural language processing capabilities that works on rule-based algorithms and replies to basic questions, like an FAQ service.

- Moderate chatbot – a chatbot with developing capabilities across all three factors.

- Advanced chatbot – one that provides the experience closest to real human conversation.

They can be found on websites and in banking mobile apps, replying to customer questions about services. But their functionality can be wider. For example, they can process customer replies to personalize services or process claims.

How it is applied. Insurance company Lemonade uses a chatbot to provide personalized offers to clients. It asks the client various questions to provide a tailored insurance policy and facilitates claim processing online.

Trōv, another insurance company, has an in-app chatbot that allows users to ask questions and manage their claims. Banks also use chatbots as part of their apps to help clients solve their problems or to send clients notifications and reports. USAA has a web chatbot and in-app chatbot that helps clients complete various tasks like reporting stolen or lost cards, changing a PIN, adding notifications. Recently they launched a voice-activated chatbot via Amazon Alexa.

Image recognition

Image recognition can be used either for enhancing customer experience or security. An example of the former is credit card scanning functionality in payment apps or ID scanning in banks. Security application entails either ID or biometric authentication in mobile banking apps.

Sometimes there’s no need for an ID or even a credit card: You can use your face and a camera to pay. In China, facial recognition technologies are applied in point-of-sale systems at stores. People who use services like WeChat Pay or Alipay can enable facial recognition in apps, and pay using connected devices. There’s already a shopping street in Wenzhou, where you can pay just showing a face to the camera of an Alipay device.

How it’s applied. Lenddo, a credit scoring solution mentioned above, has an identity verification functionality for mobile apps. It includes two types of verification: document and face capture for Android devices.

OCBC Bank has used facial recognition in their mobile app for login since 2017 for Apple iPhone X users. Card Scan has a similar solution. It’s a card scanning service that can be integrated with Android and iOS devices. This app has real-time processing functionality for debit and credit cards with a software development kit that even recognizes and prevents the use of stolen cards.

Alipay launched Smile to Pay technology at KFC. It identifies a customer’s face via mobile app, automatically charging them. In 2018 Alipay upgraded this technology with the introduction of Dragonfly POS devices with a more advanced facial recognition system that identifies fraud using photos and videos.

AI in Finance: What’s next?

Business spending on artificial intelligence is growing worldwide, and current studies predict that it’ll grow even more. Banking is the second largest industry implementing AI solutions. It’s planning to spend $5.6 billion by 2022. While businesses will focus primarily on revenue growth, the financial industry’s key areas for AI implementation will be security, decision-making, and customer experience.

However, adoption of these technologies by financial institutions goes rather slowly due to challenges that arise in the process. Among them are unclear outcomes in terms of data protection regulations, data quality, and inability to control all risks it can lead to. According to Deloitte’s 2018 report “AI and Risk Management: Innovating with confidence,” only 32 percent of surveyed companies are actively implementing AI, while 40 percent of them are still learning how to apply it in business, and 11 percent have not started implementing it at all.