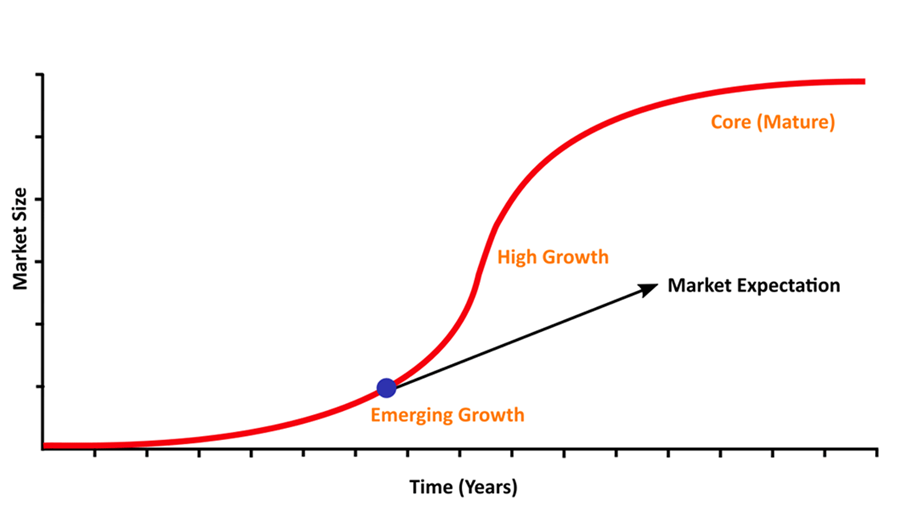

Fund manager, Insync, has developed its own investment frontier curve which looks for the spot where a stock reaches a point where earnings growth begins accelerating due to the secular forces of a megatrend.

“For us it is the blue dot on the earnings curve.

“We seek out early adopters of technology that are profitable and about to do very well.

“Market outperformance for us often has its roots in mapping out the next stage in the growth potential for already successful companies. We are banking on their success building the next phase rather than seeking an undervalued/misunderstood stock that is typically the domain of value style investing,” said John Lobb, Portfolio Manager at Insync.

There are pitfalls in going too early or too late into megatrends

Pitfalls of going too early into a megatrend can mean investing before the market is yet to see the stock’s potential and the price may lag for longer than you would wish.

Pitfalls for going too late into a megatrend can mean missing out on significant stock price outperformance associated with a durable and resilient acceleration in earnings growth.

Disruptions stocks can provide investment returns now

Insync’s investment strategy concentrates on disruption and its interrelationship with a global megatrend rather than just investing in disruptive companies.

“Our investment philosophy revolves around high quality companies. We look for companies that are benefiting from disruption, have long runways of growth through exposure to global megatrends and are highly profitable,” commented Mr. Lobb.